Option trading offers great opportunities for investors to generate significant returns. However, it also comes with inherent risks. Without proper risk management techniques, option trading can lead to substantial losses.

In this article, we will explore ten effective techniques that can help minimize losses and maximize profits in option trading, highlighting the importance of risk management in option trading.

-

Understand Options and Their Risks

BY- Tradebrains / Source- Google Images

Before venturing into option trading, it is crucial to have a solid understanding of options and the associated risks. Options are derivative contracts that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific time frame. By comprehending the mechanics and nuances of options, traders can make informed decisions and develop appropriate risk management strategies.

-

Define Risk Tolerance and Set Realistic Goals

BY- Stock.adobe / Source- Google Images

Each trader has a unique risk tolerance level, which determines their comfort with potential losses. It is essential to define your risk tolerance and set realistic goals based on your financial situation, investment objectives, and time horizon. Understanding your risk tolerance helps in determining the appropriate position sizing and selecting suitable option strategies that align with your risk appetite.

-

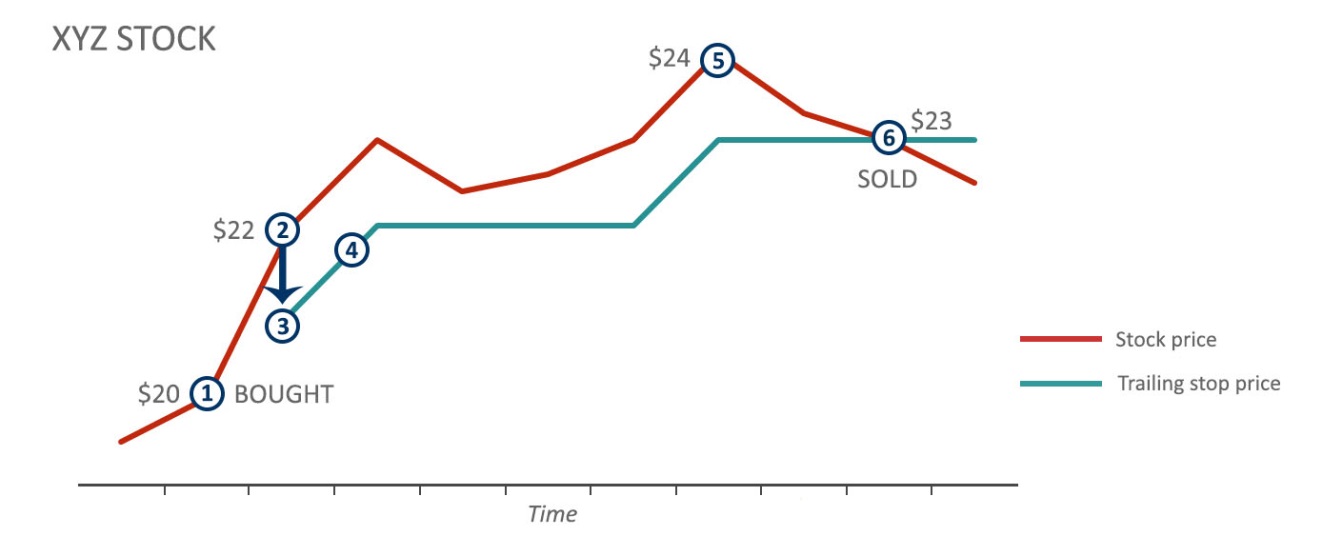

Utilize Stop Loss Orders

BY- Thebalancemoney / Source- Google Images

Implementing stop loss orders is a fundamental risk management technique that helps limit potential losses in option trading. By setting a predefined exit price level, traders can automatically sell their options when the price exceeds the specified threshold. Stop loss orders provide a safety net and protect against significant losses in case the market moves against the trader’s expectations.

-

Diversify Your Option Portfolio

BY- Navi / Source- Google Images

Diversification is a key principle of risk management in any investment strategy, including option trading. Spreading your investments across different options with varying underlying assets, expiration dates, and strike prices can help mitigate risk. A well-diversified option portfolio ensures that losses from one position can be offset by gains from others, reducing the overall impact of any single trade.

-

Implement Position Sizing

BY- Zerodha / Source- Google Images

Position sizing is a critical risk management technique that determines the amount of capital allocated to each trade. By calculating the optimal position size based on factors such as risk tolerance, account size, and the probability of success, traders can avoid overexposure to any single trade. Proper position sizing ensures that losses on individual trades are manageable and do not significantly impact the overall portfolio.

-

Use Hedging Strategies

BY- Asymmetryobservations / Source- Google Images

Hedging is a risk management technique that involves taking offsetting positions to minimize potential losses. In option trading, traders can use various hedging strategies, such as buying protective puts or selling covered calls, to reduce downside risk. These strategies provide insurance against adverse price movements and help limit losses in volatile market conditions.

-

Employ Stop-Limit Orders

BY- sec.gov / Source- Google Images

In addition to stop loss orders, stop-limit orders can be employed to enhance risk management in option trading. A stop-limit order triggers a limit order once a specified price level is reached. It combines the advantages of a stop order (limiting losses) and a limit order (providing price control). By using stop-limit orders, traders can ensure that their options are sold within a specific price range, preventing slippage during volatile market conditions.

-

Regularly Monitor Positions

BY- Viewsonic / Source- Google Images

Active monitoring of option positions is crucial for effective risk management. Markets can quickly change, and prices can hurry, impacting the profitability of option trades. Regularly monitoring positions allows traders to identify potential risks, adjust strategies, and take necessary actions to minimize losses or capitalize on profitable opportunities.

-

Conduct Thorough Analysis

BY- Outlookindia / Source- Google Images

Performing thorough analysis before entering option trades is vital for risk management. Technical analysis, fundamental analysis, and option-specific analysis can provide insights into market trends, volatility, and option pricing. By conducting comprehensive research and analysis, traders can make informed decisions, select appropriate strategies, and assess the risk-reward profile of potential trades.

-

Continuously Educate Yourself

BY- Outlookmoney / Source- Google Images

The options market is dynamic and constantly evolving. It is essential for option traders to continuously educate themselves about new strategies, market developments, and risk management techniques. Investing in ongoing education through books, courses, seminars, and online resources helps traders stay updated and adapt to changing market conditions, improving their risk management skills.

Bottom Line

Risk management is paramount for successful options trading. By employing these ten techniques, traders can minimize losses and maximize profits in options trading. Understanding options, setting realistic goals, utilizing stop loss orders, diversifying portfolios, implementing proper position sizing, employing hedging strategies, and regularly monitoring positions are essential risk management practices.

Additionally, using stop-limit orders, conducting a thorough analysis, and continuously educating oneself contribute to effective risk management in option trading. By integrating these techniques into their trading approach, option traders can navigate the market with increased confidence and mitigate potential risks.

Discover the exciting world of options trading with CurrencyVeda. Join now to gain knowledge and master the art of trading derivatives for success!

Disclaimer: This article from CurrencyVeda is for educational purposes only and should not be considered financial advice. Trading carries risks, and individuals should seek professional guidance before making any investment decisions. CurrencyVeda does not guarantee the accuracy of the information provided and is not liable for any losses incurred. Exercise caution and conduct independent research before trading in financial markets.

What is the primary goal of risk management in option trading?

The primary goal of risk management in option trading is to minimize potential losses while maximizing profits.

How can diversification help in risk management for option trading?

Diversification helps in risk management for option trading by spreading investments across different options with varying underlying assets, expiration dates, and strike prices. This strategy reduces the impact of any single trade and helps mitigate risk.

What are stop loss orders, and how do they assist in risk management?

Stop loss orders are predefined exit orders that automatically sell options when the price reaches or falls below a specified threshold. By implementing stop loss orders, traders can limit potential losses and protect against significant downturns in the market.

What is position sizing, and why is it important in risk management for option trading?

Position sizing refers to determining the appropriate amount of capital to allocate to each trade. It is crucial in risk management for option trading as it helps avoid overexposure to any single trade and ensures that losses on individual trades are manageable, safeguarding the overall portfolio.

How does continuous education contribute to effective risk management in option trading?

Continuous education is essential for effective risk management in option trading as it helps traders stay updated with new strategies, market developments, and risk management techniques. By continuously learning and adapting to changing market conditions, traders can enhance their risk management skills and make informed decisions.

[…] market education emphasizes the importance of risk management strategies. During times of volatility, it is essential to assess and manage risk effectively. Educated […]

[…] proper knowledge, strategy, and risk management, Indian investors can navigate the market effectively and capitalize on favorable trading […]